In today’s electronic era, financial security is a top priority for businesses and consumers alike. Major security breaches have compromised the largest of corporations like Target and Home Depot as well as many local merchants. Just recently, a video of a Starbucks customer discovering credit card fraud performed by her local barista has gone viral.

Unfortunately, as we head into 2016, many Montgomery County business owners do not realize that new EMV Compliance regulations have left them liable for the fraudulent behavior of criminals.

BKZ Consulting Partners in North Wales, one of the regions leading providers of payment processing services, has played an integral role in helping to secure payment data with hundreds of local merchants.

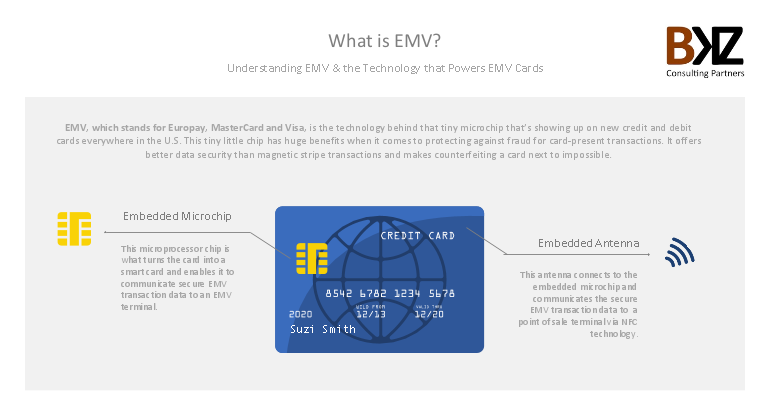

These measures have helped reduce credit cards fraud by 99% in 2015 – from 65.5 million cards in 2014 to 741,747 card in 2015. EMV enabled cards encrypt a new number each time a card is used, severely reducing the ability for hackers to gain access to customers’ valuable data.

Unfortunately, most people still have not received new EMV chip cards from their credit card companies and many retailers, large and small, have not switched over to the new processing equipment necessary to handle the new EMV chip cards. This means that many merchants are currently liable for credit card breaches.

BKZ Consulting is helping businesses and merchants from a number of industries- healthcare, retail, government, and more – comply with these new regulations.

With the technology more accessible than ever before, both consumers and merchants should make securing their data a top priority in 2016.

Local merchants interested in learning more can call BKZ Consulting at (888) 853-1012 or email information@BKZConsulting.com. Consumers should ensure that they’ve received updated EMV chip-enabled credit cards from their bank.

Here’s to a fraud-free 2016!

–Sponsored–

We Are Supported By: